irs child tax credit 2021

Parents with children ages six to 17 received up to 250 per month per child for a total of 1500. Here is some important information to understand about this years Child Tax Credit.

How The New Expanded Federal Child Tax Credit Will Work

The IRS provides the Child Tax Credit Eligibility Assistant portal that determines whether the family qualifies for the CTC.

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

. So yes its up to 2000 per eligible child in 2022. But many families are also collecting the aid despite. The tax agency said that people who believe they are eligible for these benefits but havent filed a 2021 tax return could do so on the Child Tax Credit website.

The child tax credit expansion increased the amount of money families can receive. For 2021 eligible parents or guardians can receive up to 3600 for each child who. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive.

The Child Tax Credit Update Portal is no longer available. If youre eligible you could receive. Families with a single parent.

Your eligibility for monthly Child Tax Credit payments in 2021 and send. Under the American Rescue Plan the IRS disbursed half of the 2021 Child Tax Credit in monthly payments during the second half of 2021. Married couples filing a joint return with income of 150000 or less.

These people are eligible for the full 2021 Child Tax Credit for each qualifying child. 3000 for children ages. The CTC begins to be reduced to 2000 per child if your modified AGI in 2021 exceeds.

The only way to receive the credit is to file a 2021 federal tax return. The tax credit is aimed at helping parents. 150000 if married and filing a joint return or if filing as a qualifying widow or.

There is a child tax credit each year. Child Tax Credit 2021. Its-a-write-off 3 min.

The Child Tax Credit provides money to support American families. Enhanced child tax credit. IR-2022-108 ngày 20 tháng 5 năm 2022.

It is a tax credit that you claim. Up to 3000 for each qualifying child ages 6 through 17. Butwhat about the people who would rather get a lump sum of.

Up to 3600 for each qualifying child ages 5 and under. 1200 sent in April 2020. The advance Child Tax Credit.

Three or more qualifying. When you file your 2021 tax return you will receive all of the 2021 Child Tax Credit that you are eligible for. You may have received up to half of this amount through.

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. 3600 for children ages 5 and under at the end of 2021. You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021.

Advance Child Tax Credit payments are early payments from the Internal Revenue Service IRS of 50 percent of the. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. The maximum credit amount has increased to 3000 per qualifying child between ages 6 and 17 and 3600 per qualifying child under age 6.

For 2021 here are the maximum amounts of Earned Income Tax Credit. The enhanced Child Tax Credit increased this benefit as high as 3600 a child in 2021 up from its normal amount of 2000 per child. Up to 3600 per child or up to 1800 per child if you received monthly payments in 2021.

Households that received the advance CTC payments should have gotten half. Những câu hỏi thường gặp. 150000 if you are.

IRS 2021 Child Tax Credit and Advanced Child Tax Credit Payments. What is the child tax credit expansion. They said you dont have to do anything to get the CTC payments supposedly starting in July.

WASHINGTON Hôm nay IRS đã ban hành một bộ các câu hỏi thường gặp được sửa đổi về Tín Thuế Trẻ Em Năm 2021. No changes to that are proposed yet for 2023.

New 3 600 Child Tax Credit Portal How To Unenroll From Child Tax Credit 2021 Youtube

Advance Child Tax Credit Will Be Paid Starting July 15 Nextadvisor With Time

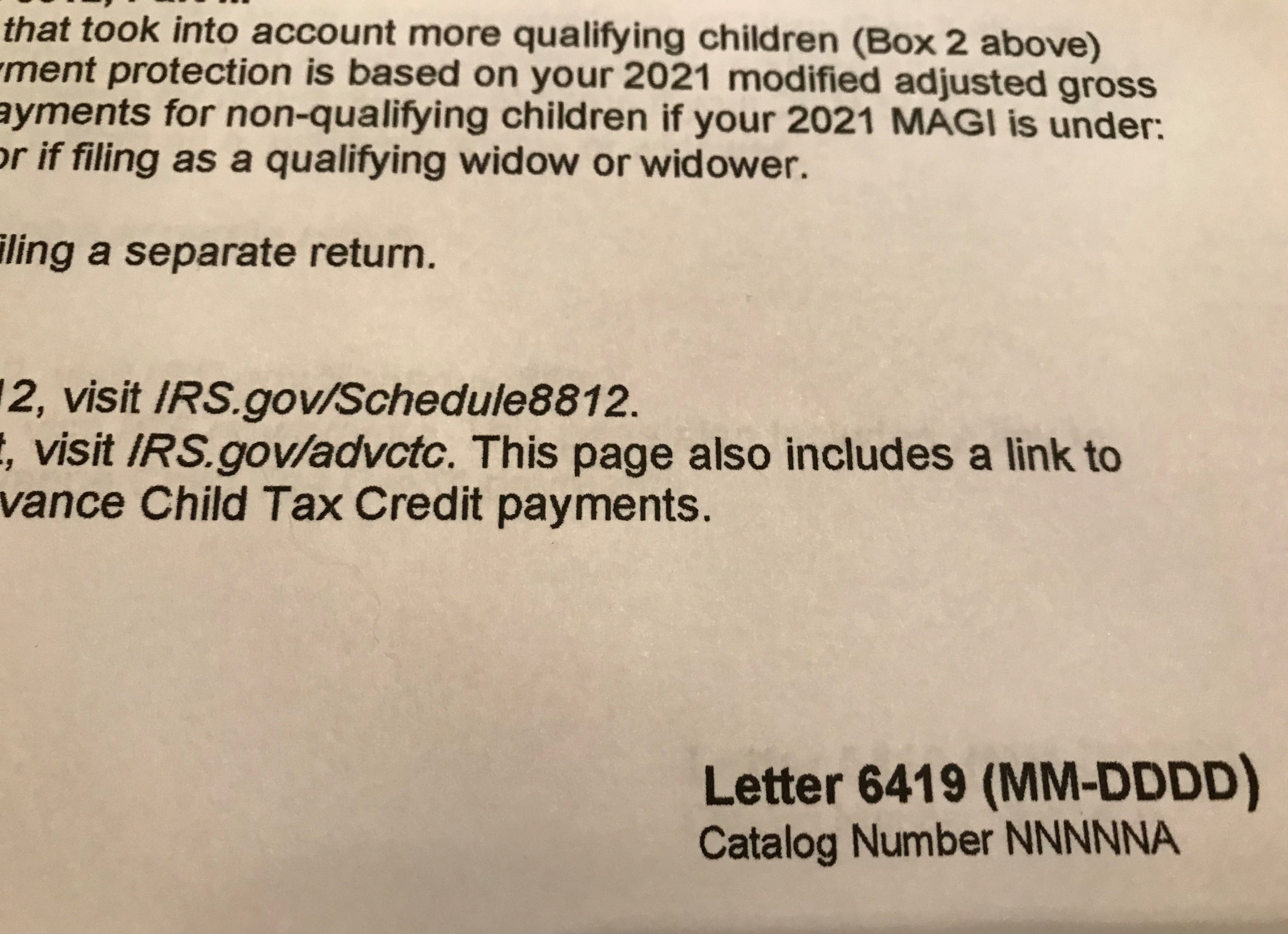

Child Tax Credit 2021 Payments How To Know If You Owe Irs Letter To Watch For

I Got My Refund Https Www Irs Gov Newsroom Irs Updates 2021 Child Tax Credit And Advance Child Tax Credit Payments Frequently Asked Questions Facebook

Irs Letter 6419 For Child Tax Credit May Have Inaccurate Information

Irs Warns Of Child Tax Credit Scams Abc News

First Monthly Child Tax Credit Payment Hits Bank Accounts Next Week

2021 Taxes Advanced Child Credit Payments The Tennessee Tribune

Advance Child Tax Credit Payments Anfinson Thompson Co

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

/cloudfront-us-east-1.images.arcpublishing.com/gray/AZXLCRNHQ5GI7LVGR72GFTAW7M.jpg)

Irs Urges Parents To Watch For New Form As Tax Season Begins

Child Tax Credit Helps Working Families Cut Child Poverty Monticello Central School District

Holton Tax Services The Irs Has Begun Sending Out Notices Regarding The New Advance Payments Of The Child Tax Credit A Photo Of The Letter Is Shown Here As We Ve Mentioned

Irs Letter 6419 For Child Tax Credit May Have Inaccurate Information

The Irs Will Be Sending Parents Monthly Payments In One Week Wfmynews2 Com

News On 2021 Child Tax Credit Refunds Irs Hiring Plans Canon Capital Management Group Llc

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

Will You Have To Repay The Advanced Child Tax Credit Payments Wdtn Com